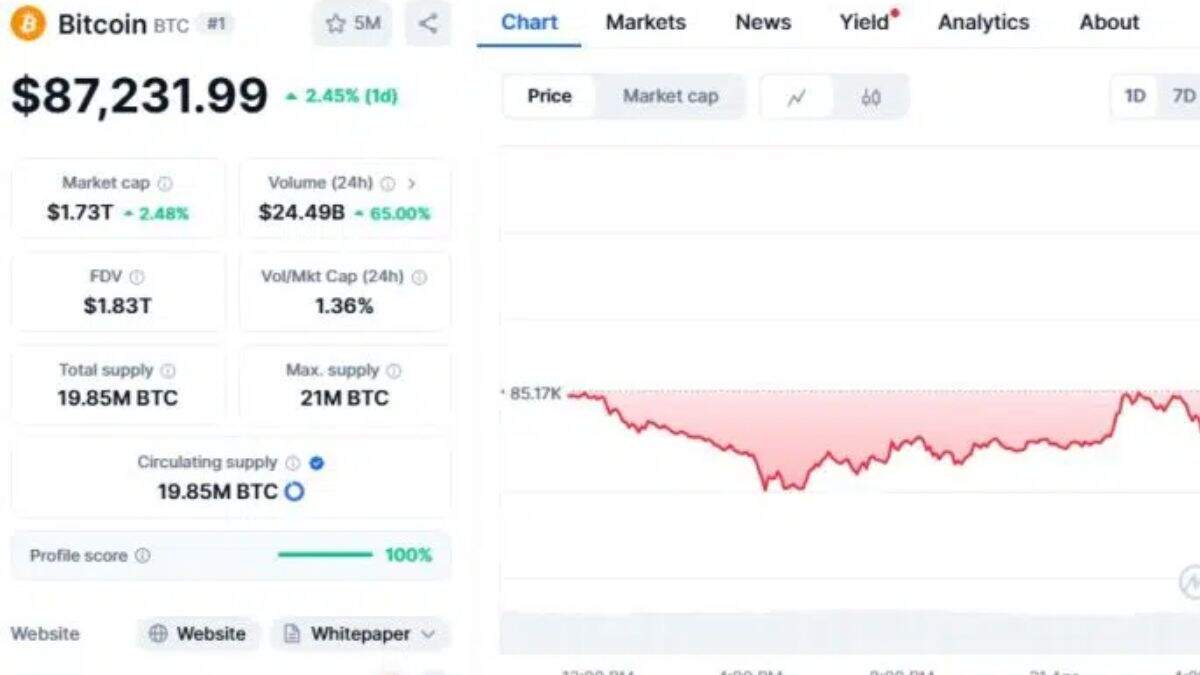

Bitcoin Surges Past $87,000, Gains Over 16% Since April Low

Bitcoin price reached $87,400 on Sunday, its highest since March 28, based on CoinMarketCap data. The largest cryptocurrency by market capitalization has risen more than $3,000 from its intraday low of $84,050 on April 20, indicating a strong bullish breakout after weeks of sideways consolidation.

Since hitting a local low just below $75,000 on April 9, Bitcoin has risen over 16%, with analysts citing renewed investor optimism and technical resilience. The rally leaves Bitcoin just 20% shy of its all-time high, fueling speculation that a retest is imminent.

"Bitcoin is breaking out," declared crypto analyst Scott Melker, aka The Wolf of All Streets, as Nasdaq futures fell 1% in early Sunday trading.

BTC Trading at the Top of Its Range

The price surge places Bitcoin at the highs of its two-month range, a major technical signal that can indicate a trend reversal on a larger scale. Analyst Rekt Capital pointed out that Bitcoin has not only surpassed a key downtrend line but has also flipped it into support—a signal interpreted as a classic bullish sign.

Bitcoin and Gold Rally Together

Bitcoin's rise follows as gold reached its 55th all-time high over the last 12 months. The uncommon overlap has caught the eye of macro analysts. On a post on X, The Kobeissi Letter reported that "the story in gold and Bitcoin is coming together for the first time in years."

This alignment indicates rising investor unease about traditional financial markets, particularly as the U.S. Dollar Index (DXY) has dropped 10% since the beginning of 2025 amid rising global trade tensions and uncertainty about interest rates.

Also Read: Top Cryptos to Watch: Mantra Struggles, Memecoin Unlock Ahead, Pi Network Concerns Grow

Market Implications

Analysts who had forecasted a fall to $83,000 are surprised. Current price action is indicative of Bitcoin decoupling from traditional equity markets, said Geiger Capital, citing Bitcoin's strength amid a pullback in tech-heavy indices.

Risk assets are in pressure and inflation has been sticky in major economies, prompting institutional and retail investors to rotate into alternative stores of value—primarily gold and Bitcoin.

Conclusion

With Bitcoin price at $87,000, market sentiment has clearly turned. The breakout from recent consolidation, combined with macro tailwinds like a weakening dollar and rising gold prices, suggests growing demand for decentralized and inflation-proof assets. If the current momentum continues, Bitcoin may soon challenge its earlier all-time highs, paving the way for a possible second-half 2025 rally.