Muhurat Trading Strategy: Caution Advised as Nifty 50 Faces Potential Decline Below 24,900 - Read Now

Muhurat Trading Strategy: Experts have asked investors and traders to be on guard in Diwali 2024 and the annual Muhurat Trading session. With Nifty 50 going to touch the lower levels below 24,900, according to Kapil Shah, technical analyst with Emkay Global, the investors need to tread warily and chalk out their approach for Muhurat Trading on the onset of Samvat 2081 while nearly all the technical indicators indicate a bearish near-term view.

Market Factors Influencing Nifty 50 on Diwali in 2024

There are many market factors, which are going to influence the Indian stock market coming into the Diwali season. Union Elections, Union Budget, China's economic recovery, volatile crude oil rates, and foreign investment inflow levels would be the definite direction influencers. All these combined along with technical patterns from charts make traders cautious.

Nifty 50 Technical Outlook by Kapil Shah

Kapil Shah has shared some rather deep technical insights regarding the Nifty 50 index, indicating various bearish signals. Here's a breakdown of some key technical patterns and trends:

: Shah drew attention to an evolving Bearish Engulfing pattern on the monthly chart of the Nifty 50 index. Throughout history, the signal on this formation has formed at market tops and there seems to be selling pressure over the short term. Thus, possible declines through November are indicated by this pattern.

: Shah drew attention to an evolving Bearish Engulfing pattern on the monthly chart of the Nifty 50 index. Throughout history, the signal on this formation has formed at market tops and there seems to be selling pressure over the short term. Thus, possible declines through November are indicated by this pattern.

Time Cycles of Nifty in the Uptrend: A study of uptrend cycles, in general, of Nifty indicates that they normally last for 40-56 months. The current uptrend of 54 months is reaching the time cycle where most uptrends are seen to top.

Spiky "M" Pattern: Shah has detected a potential of forming a Spiky "M" pattern, in this manner that can be normally observed just prior to major market tops. If this pattern completes completely, it may set off another downturn even lower in the Nifty 50 level.

Head & Shoulders and Inverted Flag Patterns: All these bearish patterns have been formed on the Nifty 50 chart, so beware. Both Inverted Flag and Head & Shoulders patterns usually signal a market decline, that is more likely to happen downward.

Nifty 50 Likely to Fall at These Levels

In terms of Shah's analysis, Nifty 50 could fall toward the levels below 24,900, with immediate downside potential toward 24,000-23,800. Should this level be broken, further declines toward 22,800-21,800 are possible. These levels emphasize the need for a cautious trading strategy during the Diwali season, since any intermediate upward movements might present profit-booking opportunities.

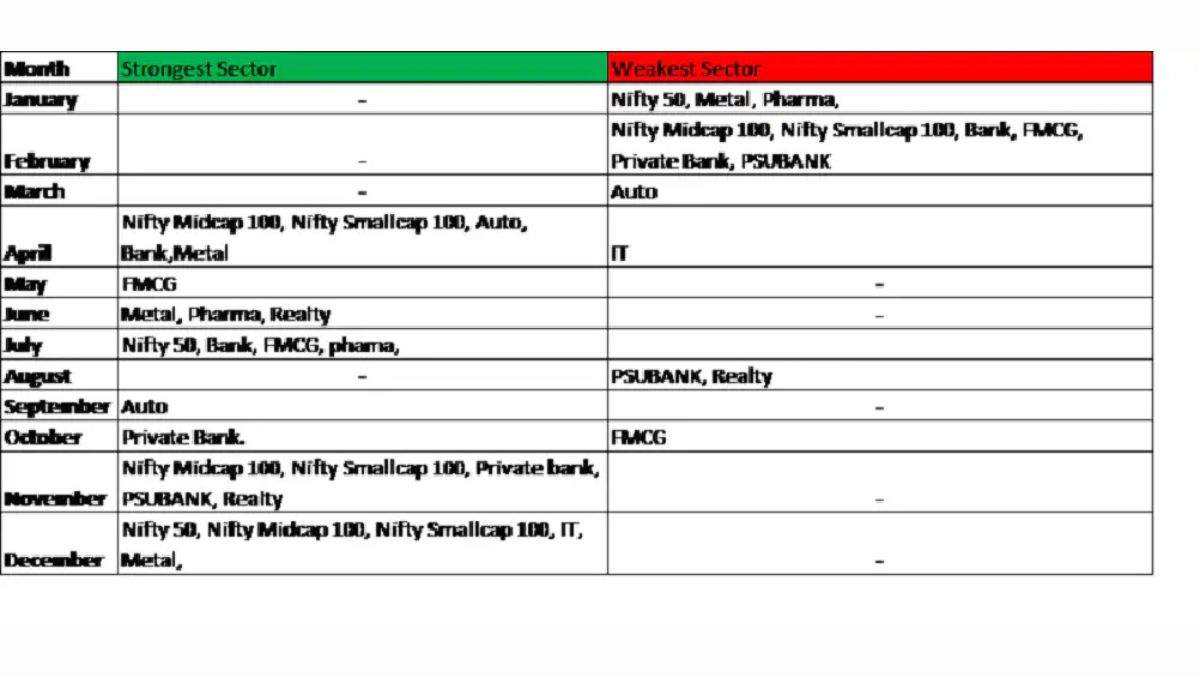

Sectoral Seasonality and Market Strategy

Sectoral analysis presents diversified performances across sectors vastly differing from historical seasonality. For the Diwali season, it becomes crucial for traders to validate sectoral strength through technical analysis and tactically rotate sectors for a better performance of the portfolio.

Muhurat Trading Tips for Investors

In the backdrop of bearish signals and an implied, rather fragile, market volatility for Diwali 2024 Muhurat Trading, one would be prudent. While the trend may give way to a brief process of profit taking upwards, on technical indications alone, caution seems to be in order.